Auto Insurance Discounts

Are you looking to save money and get auto insurance discounts in Spokane, WA? If so, you’ve come to the right place. Our independent insurance agents at Associated Agents Group are here to help you find the auto insurance policy you need at the right price. We understand that auto insurance prices have increased significantly recently. That’s why we offer price comparisons across multiple providers to ensure you find the most affordable options. Here’s why your local independent insurance agents can help you save the most on your auto insurance:

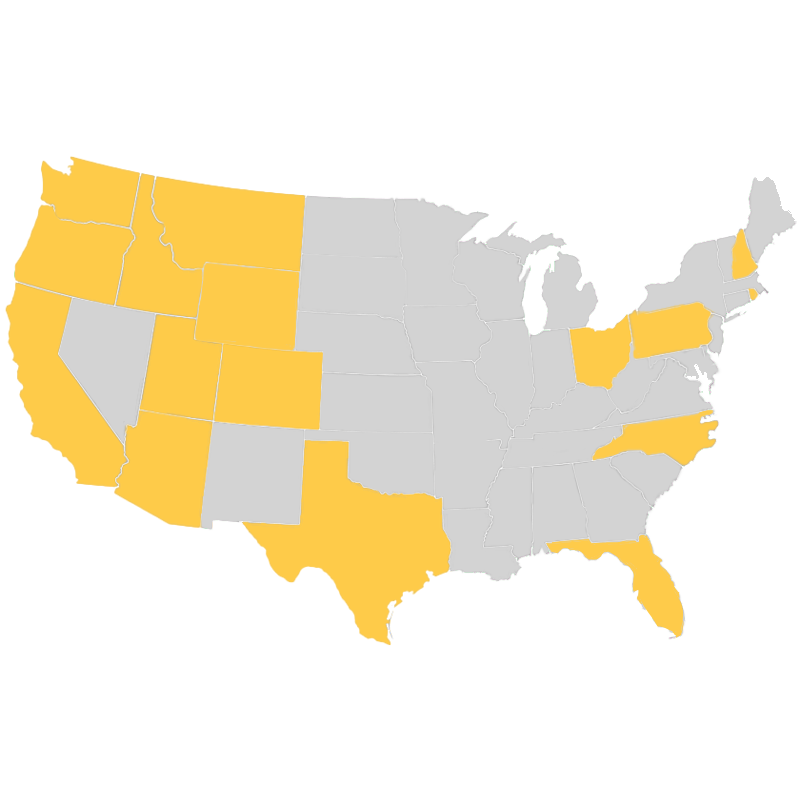

Access to Shop Around with 30 Different Insurance Carriers

We work with a variety of different insurance companies rather than being tied to a single provider. This allows us to compare policies and discounts across multiple carriers, ensuring we can find the best deals and savings while tailoring a unique policy to fit your needs.

Supreme Expertise and Knowledge

We are experts in the industry and knowledgeable about the various discounts offered by different insurers. We can identify and explain available discounts, such as safe driver discounts, multi-policy discounts, and good student discounts, helping you take advantage of every possible saving.

Personalized Insurance Services

We take the time to understand their your unique needs and circumstances. This allows us to tailor our search for discounts based on individual factors such as driving history, vehicle type, and usage patterns, ensuring you receive personalized recommendations for maximizing savings.

We Can Help you Score Washington Auto Insurance Discounts

Good Driver Discount: For drivers with a clean driving record and no accidents or violations.

Multi-Policy Discount: For bundling auto insurance with other policies like homeowners or renters insurance.

Multi-Car Discount: For insuring multiple vehicles under the same policy.

Good Student Discount: For students maintaining a certain GPA, often a 3.0 or higher.

Low Mileage Discount: For drivers who travel fewer miles annually.

Defensive Driving Course Discount: For completing a state-approved defensive driving course.

Safety Features Discount: For vehicles equipped with safety features like anti-lock brakes, airbags, and anti-theft systems.

Paid-in-Full Discount: For paying the annual premium in one lump sum instead of monthly installments.

Automatic Payment Discount: For setting up automatic payments from a bank account.

Loyalty Discount: For staying with the same insurance company for several years.

Military Discount: For active-duty military personnel, veterans, and sometimes their families.

Affinity Group Discount: For members of certain organizations, alumni associations, or professional groups.

Early Signing Discount: For signing up for a new policy before the current one expires.

Homeowner Discount: For owning a home, even if it’s not insured with the same company.

Electronic Billing Discount: For opting to receive bills and policy information electronically.

Discounts can vary by company and eligibility requirements.

Insurance Premiums in Washington are Rising

In Washington, insurance premiums have been going up, and here’s why: more frequent accidents and severe weather patterns are leading to higher claims and costs. Inflation has made repairs pricier, adding to expenses for insurance companies. Plus, new regulations and market shifts are influencing premium rates. But don’t worry — just because premiums are rising doesn’t mean you’re stuck with your current high-priced premium. We’re here to help you find a great policy at a better price without compromising on coverage.

Increased Claims and Costs:

- The frequency and severity of claims have been increasing, partly due to more severe weather events, accidents, and natural disasters. This rise in claims means insurance companies are paying out more, leading them to increase premiums to cover these costs.

Inflation and Repair Costs:

- Inflation impacts various aspects of insurance, including the cost of repairing vehicles and property. As the cost of materials and labor rise, so do the costs for insurance companies to settle claims, resulting in higher premiums for policyholders.

Regulatory Changes and Market Conditions:

- Changes in state regulations and the overall insurance market can also affect premiums. For example, new laws or regulations that increase the minimum coverage requirements or change the way insurance companies must calculate risk can lead to higher premiums. Additionally, market conditions such as increased competition or changes in reinsurance costs can also impact premium rates.

Let us Help Guide you on your Insurance Journey

At Associated Agents Group, we’re dedicated to finding you the best auto insurance deals in Spokane, WA. Our team of independent agents is committed to navigating the rising costs and providing you with personalized solutions tailored to your needs. By leveraging our price comparisons and deep industry knowledge, we can help you secure affordable coverage without sacrificing quality. Let us work with you to find the perfect policy and make sure you’re getting the most value for your money. Fill out the contact form or give us a call at 509-928-7528 for a free auto insurance quote, today.