Think of car insurance coverage as your trusty co-pilot on Washington’s roads, there to help if things take an unexpected detour.

Life happens, whether it’s a fender bender, a cracked windshield from loose gravel, or a surprise encounter with a deer on a foggy mountain drive. For Washington drivers, understanding the right car insurance coverage can make all the difference in keeping you safe on the road while saving you money.

Did you know that Washington ranks among the top states for uninsured drivers? That means having the right coverage isn’t just a good idea, it’s essential. By knowing what types of car insurance coverage you truly need, and what you can skip, you could save hundreds every year. From factoring in your car’s value to meeting Washington’s insurance requirements, let’s explore the details so you cruise confidently through every twist and turn ahead.

Collision Coverage Essentials for Washington Drivers: What You Need to Know

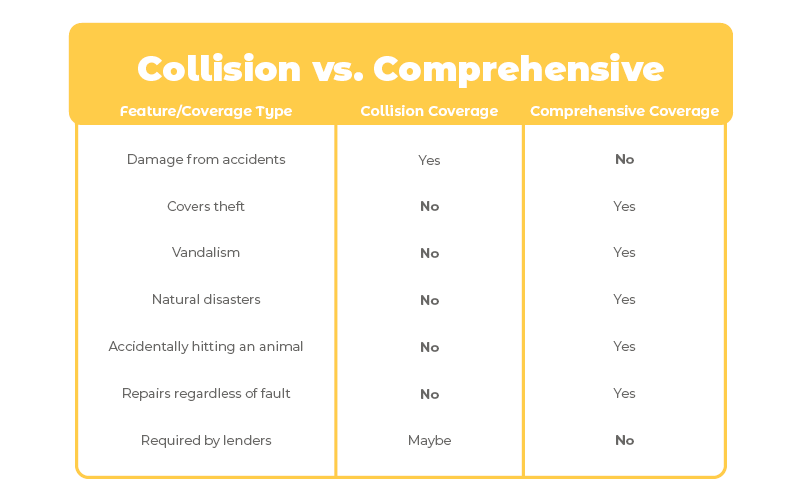

Picture collision coverage as your financial shield when mishaps strike. Whether it’s a classic fender bender, a scrape against a fence, or an unexpected bump with a parked car, you’ll want to know what you’re covered for. For many Washington drivers, collision car insurance coverage offers peace of mind, especially if your vehicle is newer or expensive to replace.

However, it’s important to note that collision coverage comes with a deductible, meaning you’ll pay a set amount before insurance kicks in. For example, with a $500 deductible on a $3,000 repair bill, you’d pay the first $500, and insurance would cover the rest. For older cars with lower market values, paying for collision coverage might not be worth it. If the cost of car insurance coverage is more than 10% of your car’s current value, it may be time to consider dropping collision to keep your budget in check.

Comprehensive Car Insurance Coverage Explained: Your Protection Against Unexpected Damages

Comprehensive coverage acts as your safety net against the unexpected, protecting you from non-collision events like theft, vandalism, and natural disasters. For Washington state drivers, this type of car insurance coverage is especially valuable if you park outside, live in a high-theft area, or face extreme weather. It shields you from incidents beyond your control, like hail damage or a fallen tree branch.

Just like collision coverage, comprehensive insurance has a deductible that you set when creating your policy. While it sounds extensive, it’s important to know that comprehensive coverage doesn’t cover normal wear and tear or mechanical breakdowns. Understanding these details can help you make informed decisions about their auto insurance needs.

Why Washington Lenders Often Require Both Collision and Comprehensive Car Insurance Coverage

When financing or leasing a vehicle in Washington, both collision and comprehensive car insurance coverage are usually required by lenders. These coverages protect their investment in case of accidents or unforeseen damage, ensuring your vehicle is covered for repairs or replacement.

Once your car loan is paid off, you have the flexibility to review your coverage. You can decide if both collision and comprehensive insurance are still necessary, based on your vehicle’s value and condition.

Regularly reassess your car insurance coverage needs to ensure you’re adequately protected, especially in areas, like Washington, that have all four seasons.

Finding the Right Balance: Choosing Deductibles and Premiums for Car Insurance Coverage

Choosing the right deductible for your car insurance coverage is key to managing your costs. A higher deductible lowers your monthly premium but means more out-of-pocket costs if you file a claim. A lower deductible offers less out-of-pocket cost but higher premiums.

Choosing the Right Deductible for Your Budget

For many Washington drivers, a deductible between $500 and $1,000 strikes a good balance. It keeps premiums affordable and covers you when it’s really needed. Consider keeping this amount in an emergency fund to stay financially prepared if a claim arises.

When to Drop Collision or Comprehensive Car Insurance Coverage in Washington – Expert Tips

If you’re thinking about dropping one or both of these coverages, there’s a few things to consider!

Your Car’s Age and Value

If your car’s value is low, collision and comprehensive might not be worth it. Generally, if your car is worth less than $5,000, the potential payout might not justify the extra cost.

Risk Tolerance

Are you comfortable with the “self-insurance” approach? Some Washington state drivers set aside funds to cover potential damages if they choose to forego certain coverages.

Where You Park

Drivers with access to secure parking, like a garage, face less risk and may not need comprehensive coverage.

Your Driving Habits

If you drive infrequently, such as working remotely or using public transit, collision coverage may not be as necessary.

Is Liability Coverage Enough for Washington State Drivers?

Liability coverage is the minimum requirement for car insurance coverage in Washington state, covering medical expenses and repair costs for the other driver if you’re at fault. Liability insurance, however, won’t cover repairs to your own car if you’re in an accident. For budget-conscious drivers with older vehicles, liability-only coverage might make sense as long as you’re prepared to pay for your own repairs if needed.

Car Insurance Checklist for Washington State Drivers

To help make your decision, here’s a quick guide:

Calculate Your Car’s Value:

Use tools like Kelley Blue Book to get an accurate estimate of your vehicle’s market value.

Compare Car Insurance Costs:

Request quotes for different types of car insurance coverage, including liability-only, liability & comprehensive, and full coverage. Weigh these costs against the protection they offer.

Estimate Out-of-Pocket Potential:

Consider your ability to cover out-of-pocket costs for repairs. If the potential cost feels manageable, it may make sense to skip some coverages.

Which Car Insurance Coverage Is Right for You?

Collision Coverage:

Recommended if you have a newer vehicle, drive frequently, or want to minimize out-of-pocket repair costs after an accident.

Comprehensive Car Insurance Coverage:

Ideal if you live in areas of Washington with high rates of theft, vandalism, or natural disaster risks, and if you park outside or in a high-traffic area.

Both Coverages:

Best for financed or leased cars, or for Washington drivers seeking maximum protection and peace of mind.

Liability Only:

A budget-friendly option for older cars with lower values or for drivers who can handle potential repair costs out of pocket.

Car Insurance Coverage: Smart Strategies for Washington Car Insurance Coverage

Now that you’re equipped with the details, you’re ready to make the best call for your coverage. Take a closer look at your car’s value, your neighborhood, your driving habits, and your comfort with financial risk. By weighing these factors, Washington drivers can confidently select the car insurance coverage that truly fits their lifestyle—and maybe even free up some extra cash for other priorities. Remember, choosing the right auto insurance isn’t just about meeting requirements; it’s about finding peace of mind on every drive.

If you need help, get in touch with us at Associated Agents Group. Our experienced team knows Washington’s insurance landscape inside and out and can guide you in finding the ideal policy that meets your needs and budget. Drive with confidence, knowing you have expert support every step of the way. Call us at 509-928-7528 or fill out our online contact form.