Protect Your Spokane Business Today

In today’s digital age, protecting your business from cyber threats is more important than ever. At Associated Agents Group, we offer specialized cyber liability insurance in Spokane to safeguard your business against the ever-evolving risks of the online world. In fact, cyber risks in Washington state are currently soaring. In 2022, The FBI’s Internet Crime Complaint Center (IC3) reported over 10,000 cyber related complaints. The total losses linked to these cybercrimes in Washington exceeded $130 million dollars. If your a small, medium or large business, you’ll want to ensure you’re protected!

Cyber Liability Insurance

What is Cyber Liability Insurance?

Cyber liability insurance provides crucial protection for businesses facing potential cyber risks, including data breaches, hacking, and other cyber-related incidents. This coverage helps mitigate the financial impact of a data breach, such as legal fees, notification costs, and regulatory fines.

Why Do You Need Cyber Liability Insurance in Spokane?

Your Spokane business likely relies on digital tools and systems more than ever before, but the risk of cyber attacks has grown. Cyber liability insurance helps you navigate these risks by offering coverage for:

Data Breach Costs

Covers expenses related to notifying affected individuals and managing the fallout of a data breach.

Legal Expenses

Provides coverage for legal costs arising from lawsuits or regulatory investigations.

Business Interruption

Helps replace lost income if your business operations are disrupted due to a cyber incident.

Crisis Management

Offers support for managing the public relations aspects of a cyber attack.

Industries who are Vulnerable to Cyber Risk

Of course, there are certain industries that are particularly vulnerable to cyber risks due to the nature of their operations. These industries often handle sensitive information that puts them at an increased risk of ransomware attacks, data breaches and more. If your business falls under any of these categories, you should be extra cautious and consider cyber risk as a serious threat.

These Industries Include:

Healthcare Services

With the handling of personal health information and patient records, healthcare providers are prime targets for cyber attacks. Cyber liability insurance helps cover the costs associated with data breaches and regulatory fines.

Financial Services

Banks, investment firms, and insurance companies manage vast amounts of sensitive financial data. Protecting this data with cyber liability insurance is essential to mitigate risks and manage potential fallout.

Retail · Online or In-Person

Retailers that process customer payments and store personal information are at risk of cyber attacks. Insurance helps cover the costs of data breaches and system disruptions.

Technology Companies

Tech firms often store sensitive client data and intellectual property, making them a target for cyber threats. Cyber liability insurance provides coverage for data breaches and business interruptions.

Education

Schools and universities handle a wealth of personal data, including student records and financial information. Cyber liability insurance helps protect against the financial impact of data breaches and system failures.

Cyber Attacks | Rising Risks in Washington State

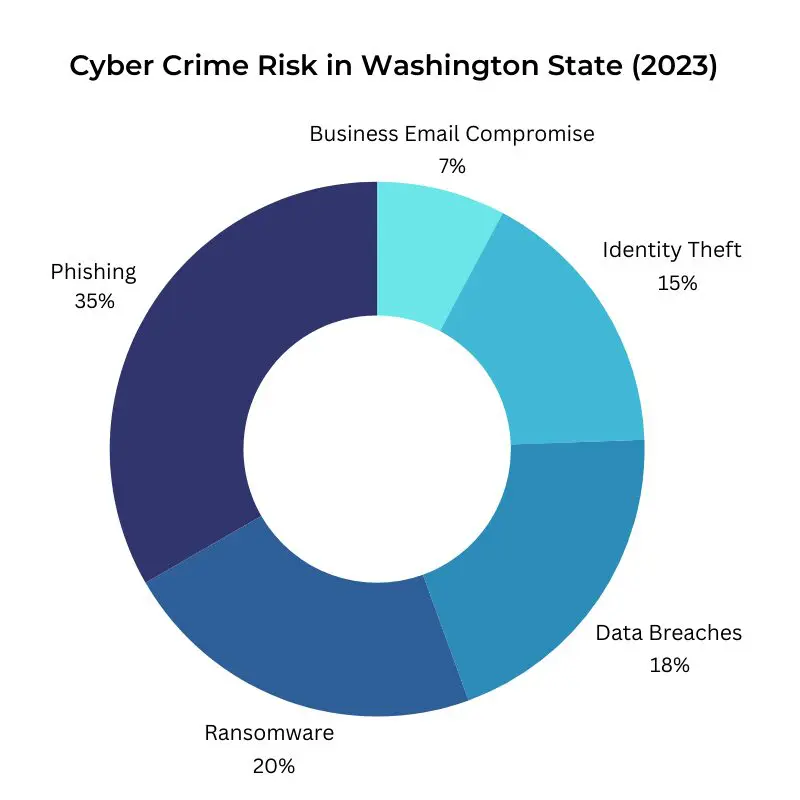

Washington state faces a rising threat from various crime risks, impacting individuals and businesses alike. From cybercrime like phishing and ransomware to property crimes and identity theft, the state experiences a wide range of dangers. Understanding these crime risks in Washington is essential to protect yourself and your assets.

The chart above gives you a closer look at the most common cybercrime risks in Washington State. Phishing, which makes up 35% of cases, is where scammers try to trick you into sharing personal details through fake emails or websites. Ransomware, accounting for 20%, locks you out of your own computer or data until you pay up. Data breaches come in at 18%, exposing sensitive information you thought was safe. Identity theft, at 15%, involves someone stealing your details to commit fraud. Rounding out the list, business email compromise and tech support fraud make up 7% and 5% of cyber threats. Understanding these risks helps you stay one step ahead and keep your personal information secure.

Phishing

Phishing, which makes up 35% of cybercrime cases, involves scammers tricking you into sharing personal details through fake emails or websites. These deceptive messages often appear to be from trusted institutions, such as banks or online services. They might ask you to click on a link leading to a fraudulent site designed to steal your credentials or financial information. To protect yourself, always verify the authenticity of unsolicited requests for personal data before responding.

Ransomware

Accounting for 20% of cyber threats, ransomware is one of the more alarming risks out there. Imagine trying to log into your computer, only to find everything locked down—your files, photos, and important documents completely out of reach. Then, a message pops up demanding payment, often in cryptocurrency, before you can regain access to your data. It’s a stressful and frustrating situation, and unfortunately, many people and businesses face this reality. Paying the ransom doesn’t always guarantee you’ll get your data back, which is why it’s crucial to have strong security measures in place to prevent this from happening in the first place.

Data Breaches

Data breaches occur when unauthorized individuals gain access to sensitive information, like your personal or financial details. This often happens through hacking, weak security, or accidental leaks. Once your data is compromised, it can be misused for fraud or identity theft. To safeguard yourself, regularly monitor your accounts for suspicious activity, use strong passwords, and stay informed about potential breaches affecting your personal information. Taking these steps can help protect you from the fallout of a data breach.

Identity Theft

Identity theft, which makes up 15% of cyber attacks, happens when someone steals your personal information to commit fraud. This could mean using your details to make unauthorized purchases, open accounts in your name, or even take out loans. It’s like having your identity hijacked! To protect yourself, be cautious with sharing personal info, monitor your financial accounts regularly, and use strong, unique passwords for your online accounts.

Business Email Compromise

Business email compromise and tech support fraud account for about 7% and 5% of cyber threats. Business email compromise happens when scammers hijack a company’s email to trick employees into transferring money or sensitive info. Tech support fraud involves fake tech support agents convincing you to grant access to your computer or pay for fake services. Stay cautious with unexpected emails or calls and always verify the legitimacy of any tech support requests.

Ensure Your Remain Compliant with your Cyber Liability Insurance Requirements

Navigating cyber liability insurance requirements can be tricky, but an independent insurance agent can help. They ensure you stay compliant by guiding you through the necessary steps and keeping you informed about policy updates. Negligence is a common reason for cyber liability claims being denied—something you want to avoid. With personalized advice and proactive management, your agent will help safeguard your business against costly mistakes and ensure you’re covered when it counts.

Tailored Coverage for Spokane Businesses

Every business in Spokane is unique, and so are its cyber risks. Our team at Associated Agents Group can work closely with you to tailor a strong business insurance portfolio with cyber liability insurance.

Whether you run a small local business or a larger enterprise, we ensure you have the right coverage to protect against a variety of risks. Our commitment to transparency and client advocacy sets us apart. We understand the complexities of cyber liability insurance and our team is here to guide you.

Get Started Today

Don’t wait until it’s too late. Protect your business with reliable cyber liability insurance. Contact Associated Agents Group in Spokane to learn more about our tailored insurance solutions and how we can help you safeguard your business from cyber threats and digital risks. By choosing Associated Agents Group, you’re not only protecting your business but also partnering with a team dedicated to your success. Contact us today for a free quote and ensure your business is prepared for any cyber risks that come your way. Call us at 509-928-7528 or fill out the contact form. We look forward to serving you!