As we look ahead at 2025, businesses near and far are facing an insurance revolution driven by one of the most pressing challenges of our digital age: cyber risks.

In a world where cyber threats are becoming increasingly sophisticated, insurers are rethinking their approach to underwriting. With a recent uptick in cyberattacks, Cybersecurity has become a primary factor influencing how business policies are shaped. That’s why industries like tech, healthcare, and finance, need to know how cyber risks can affect their insurance coverage and how to stay protected.

In this post, we’ll explore how these evolving cyber risks are reshaping the underwriting process and why staying ahead of these threats is crucial to defending your business against criminals.

What is Insurance Underwriting?

Investopedia

Insurance underwriters receive customer applications and decide whether to offer them a policy on the basis of various criteria. If they do approve the application, the underwriters also set premiums and coverage amounts.

The Evolution of Cyber Risks in 2024

Cyber risks have been a rapidly growing concern for years, but the intensity and frequency of these threats have escalated dramatically in recent years. According to MIT Sloan, Data breaches increased by nearly 20% in the first nine months of 2023 compared with all of 2022, and ransomware attacks escalated by almost 70% in the same time frame. From ransomware attacks to data breaches, no industry is immune to the dangers posed by keyboard-slinging cybercriminals.

In 2024, insurers are requiring reassessment of risk factors frequently and rigorously. This means that businesses need to understand their cyber risks in greater detail and how those risks influence the terms of their cyber insurance policies.

Cyber Risks and Insurance Underwriting: What’s Changed?

Historically, cyber insurance was seen as an optional addition for business insurance portfolios. It was often considered “nice-to-have” rather than a need. However, in 2024, cyber insurance is on the rise and has become a critical part of the underwriting process, especially for businesses that depend heavily on digital infrastructure. Think retail, healthcare, government & finance industries that store personal records, payment methods and highly sensitive data on their computers.

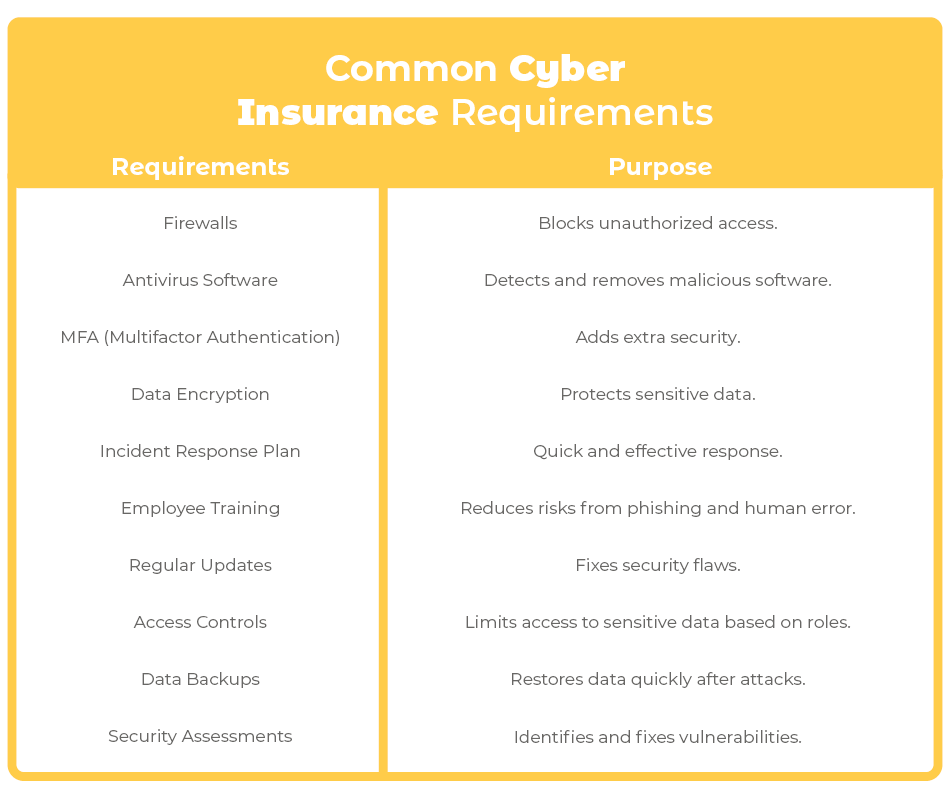

These days, underwriting involves a deeper dive into a company’s cybersecurity measures. Here are a few things underwriters pay close attention to, and so should you:

- Firewalls

- Employee training

- Encryption practices

- Incident response plans

If you have all your ducks in a row, you’ll be a great ally to your insurance company. If not, you may be at risk of a higher premium, losing your coverage or having a claim denied. Insurers want to know how well a company is prepared for cyber risks and what steps they are taking to prevent potential breaches.

For instance, let’s consider a small e-commerce business that recently experienced a phishing attack, compromising customer credit card information. While they had cyber insurance, they didn’t read the fine print or follow the security requirements associated with it. Now, their policy won’t fully cover the costs of the attack. This means they’ll experience financial loss, their reputation has been compromised and they’ll need to seriously reassess their cybersecurity needs.

The Importance of Tailored Cyber Insurance Policies

At Associated Agents Group, we believe in the power of tailored cyber insurance policies. Every business faces unique cyber risks depending on size, industry, and digital footprint. For example, some financial institutions may need cyber insurance that covers the risks associated with fraud and financial theft, while a healthcare provider may require coverage for breaches involving sensitive medical records.

The underwriting process is transforming to reflect these differences. That’s why we work closely with our clients to assess their specific cyber risks and recommend the right coverage options.

Emerging Cyber Risks in 2024

As 2024 comes to an end, we’re seeing the emergence of new cyber risks that are increasingly influencing the underwriting process. One of the most significant developments is the rise of artificial intelligence (AI)-powered attacks. Cybercriminals are using AI to conduct sophisticated attacks, such as deepfake fraud and automated data scraping, making it more challenging for traditional security measures to keep up.

For businesses to stay ahead of these emerging threats, cyber insurance policies must evolve as well. It’s not just about covering the costs of a data breach anymore, it’s about staying ahead of threats that are more complex and harder to predict.

High-Profile Cyber Attacks That Are Reshaping How We Approach Cybersecurity

Here’s a few real-world examples of high-profile cyber attacks that have shook industries far and wide.

MGM Resorts: Ransomware Disruption Hits Key Operations

In September 2023, MGM Resorts fell victim to a major ransomware attack that affected several key systems, from reservations to in-casino services. The BlackCat group claimed responsibility, and the attack led to the encryption of more than 100 hypervisors. This incident is a stark reminder of how vulnerable large businesses can be to cyber threats.

Microsoft: Data Breach Exposes Sensitive Emails

In January 2024, Microsoft experienced a significant breach when the Russia-linked Midnight Blizzard group exposed sensitive emails from its leadership and cybersecurity teams. The hackers took advantage of weaknesses in multi-factor authentication, putting confidential communications, including those with federal agencies, at risk.

3CX: Hackers Exploit Software Update for Data Theft

In March 2024, the Lazarus group, a North Korean hacker team, launched a sophisticated supply chain attack on 3CX. By infecting the company’s VoIP software with a trojanized update, the attackers were able to steal credentials and sensitive data from over 350,000 businesses worldwide.

While you can imagine the extreme cybersecurity measures these well-known companies most likely had in place, it’s important to note that the evolving strategies these cybercriminals use are even outsmarting industry technology titans. That’s why using cyber insurance as your safety net is more important than ever before.

How Insurance Underwriting Is Addressing Evolving Cyber Risks

Many insurance companies are employing advanced data analytics and machine learning models to assess risk more accurately. This allows insurers to determine the likelihood of an attack based on real-time data, which helps in pricing cyber insurance policies more effectively.

Additionally, insurers are offering more flexible policies that can be adjusted as cyber risks evolve. For example, a company’s policy might include coverage for a specific type of cybercrime, like ransomware, but that coverage can be expanded if the business starts operating in a higher-risk environment.

The Future of Cyber Insurance

As cyber risks continue to evolve, cyber insurance will play an even more pivotal role in the protection of businesses worldwide. Insurance companies will need to stay ahead of emerging threats, and businesses must remain vigilant in their cybersecurity practices to ensure they’re adequately covered.

At Associated Agents Group, we’re committed to helping our clients navigate these changes by offering tailored business insurance policies that reflects their unique cyber insurance needs. As the cyber risks landscape continues to shift as we enter 2025, we’ll be right by your side, ensuring your business is properly protected with a customized business insurance policy. You can reach us at 509-928-7528 for a free insurance review and quote. Or, learn more about our business insurance policies today.