As we anticipate a dry summer, the threat of wildfire season 2024 in Washington is becoming an increasingly pressing concern for businesses, especially those located in areas prone to these natural disasters. Wildfire season, which typically peaks in the hot, dry summer months, can bring unprecedented challenges, from physical destruction to operational disruptions. In such times, having a strong business insurance portfolio can be the difference between recovery and closure. Here’s how business insurance can provide a safety net during wildfire season.

Understanding the Risks

Wildfires are unpredictable and can spread rapidly, leaving a trail of destruction. For businesses, this means potential damage to property, inventory, and infrastructure. Beyond the physical damage, wildfires can cause significant downtime, disrupt supply chains, and lead to substantial financial losses. The impact can be devastating, particularly for small and medium-sized companies that may lack the resources to withstand prolonged disruptions.

Types of Business Insurance Coverage

To adequately protect your business during wildfire season, it’s essential to understand the different types of insurance coverage available:

Property Insurance: This is the most critical form of coverage for businesses in wildfire-prone areas. It covers the physical assets of the business, including buildings, equipment, and inventory. In the event of a wildfire, property insurance can help cover the cost of repairs or replacements, minimizing the financial burden on the business.

Business Interruption Insurance: Also known as business income insurance, this coverage is designed to compensate for lost income and operating expenses during periods when a business is forced to close or reduce operations due to wildfire damage. This can include expenses such as payroll, rent, and other ongoing costs, helping the business stay afloat until normal operations can resume.

Commercial Auto Insurance: For businesses that rely on vehicles, such as delivery services or construction companies, commercial auto insurance is essential. This coverage protects company vehicles that may be damaged by wildfires, ensuring that the business can continue its operations without significant financial strain.

Liability Insurance: Wildfires can lead to situations where a business might be held liable for damage caused to neighboring properties or injuries sustained by employees or customers. Liability insurance helps cover legal fees and any settlements or judgments, providing crucial financial protection.

Prepare for Wildfire Season 2024 in Washington

While insurance is vital, proactive measures can further enhance a business’s resilience during wildfire season. Here are some steps to consider:

1. Risk Assessment: Conduct a thorough risk assessment to identify vulnerabilities and implement mitigation strategies, such as creating defensible space around property, installing fire-resistant materials, and maintaining fire suppression systems.

2. Emergency Planning: Develop and regularly update an emergency response plan. This should include evacuation procedures, communication protocols, and contingency plans for maintaining operations.

3 Employee Training: Ensure that employees are trained on wildfire safety and emergency procedures. Regular drills can help prepare staff to respond quickly and efficiently in the event of a wildfire.

4. Document Preservation: Safeguard important business documents and records by storing them digitally and offsite. This ensures that critical information is accessible even if physical copies are destroyed.

Find an Independent Insurance Agent

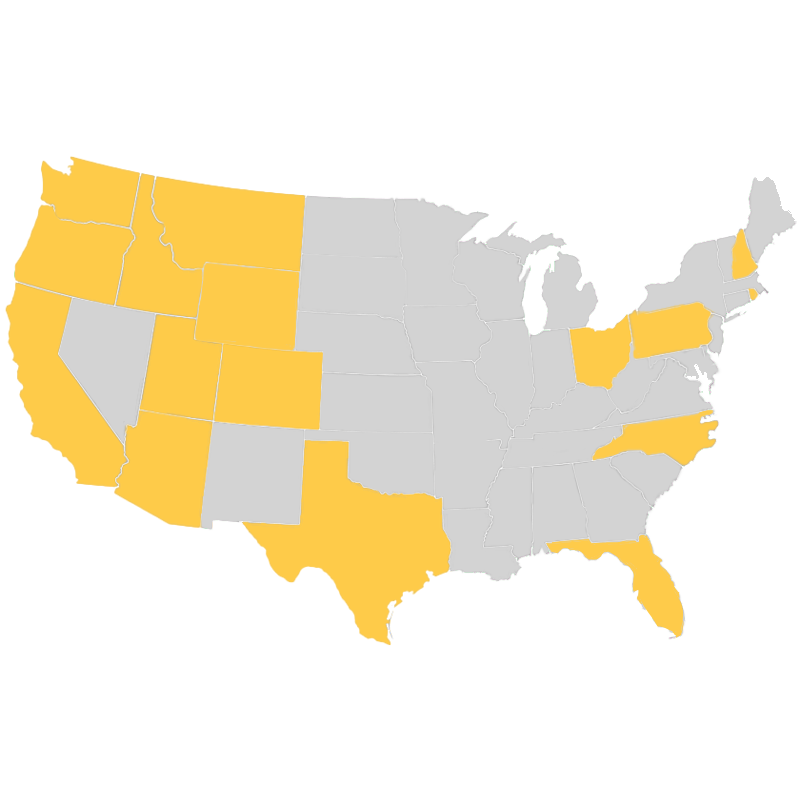

When selecting an independent insurance agent, it’s important to choose one that understands the unique risks associated with wildfires and can offer tailored coverage options. Work with an insurance agent who can help assess your specific needs and recommend appropriate policies. In the aftermath of a wildfire, a responsive and supportive insurance agent can significantly ease the recovery process.

Wildfire season poses a significant threat to businesses, but with the right insurance coverage and preparedness measures, it’s possible to mitigate the impact and ensure continuity. Business insurance not only provides financial protection but also peace of mind, allowing business owners to focus on recovery and rebuilding. As wildfires become an increasingly common concern, investing in comprehensive insurance coverage is a prudent and essential step for safeguarding your business’s future. If you are in need of Commercial Insurance, our independent insurance agents can help. Contact us at 509.928.7528 or fill out the form below. We’ll be in touch soon.