Protect Your Family with Life Insurance

Finding the right Life insurance in Washington is all about giving your loved ones peace of mind and financial security when they need it most.

At Associated Agents Group, we specialize in providing personalized life insurance solutions to help you protect your family’s future. Here’s just a few things life insurance can do for you:

- Make up for your lost income.

- Fund your child’s education.

- Paying off household debt.

- Paying for your funeral and other related expenses.

Plus, Permanent Life Insurance offers a cash value component which can be put to good use during your lifetime!

Types of Life Insurance in Washington – Get a Free Quote

Term Life Insurance: Affordable, temporary coverage with no cash value.

Life is unpredictable, but your peace of mind doesn’t have to be. At Associated Agent’s Group, we offer tailored life insurance solutions to protect your loved ones and secure your legacy.

Contact Associated Agents Group for Life Insurance in Spokane Today

Get in touch with us today to explore your life insurance options. Our dedicated team in Spokane Valley is ready to provide you with a personalized plan that fits your needs.

Call for a Free Quote

Frequently Asked Questions About Life Insurance in Washington

What is life insurance, and why is it important?

Life insurance is a financial safety net that provides money to your loved ones if you pass away. It can cover lost income, debts, education expenses, funeral costs, and more. This ensures your family’s financial security during tough times.

How do I choose between term life and whole life insurance?

- Term Life Insurance: Best for short-term needs (e.g., mortgage or young children) and budget-friendly premiums.

- Whole Life Insurance: Ideal for lifetime coverage, cash value growth, and estate planning.

What is the cash value in life insurance, and how can I use it?

The cash value is a feature of permanent life insurance that acts like savings. You can borrow against it or withdraw funds for major expenses like education, emergencies, or retirement.

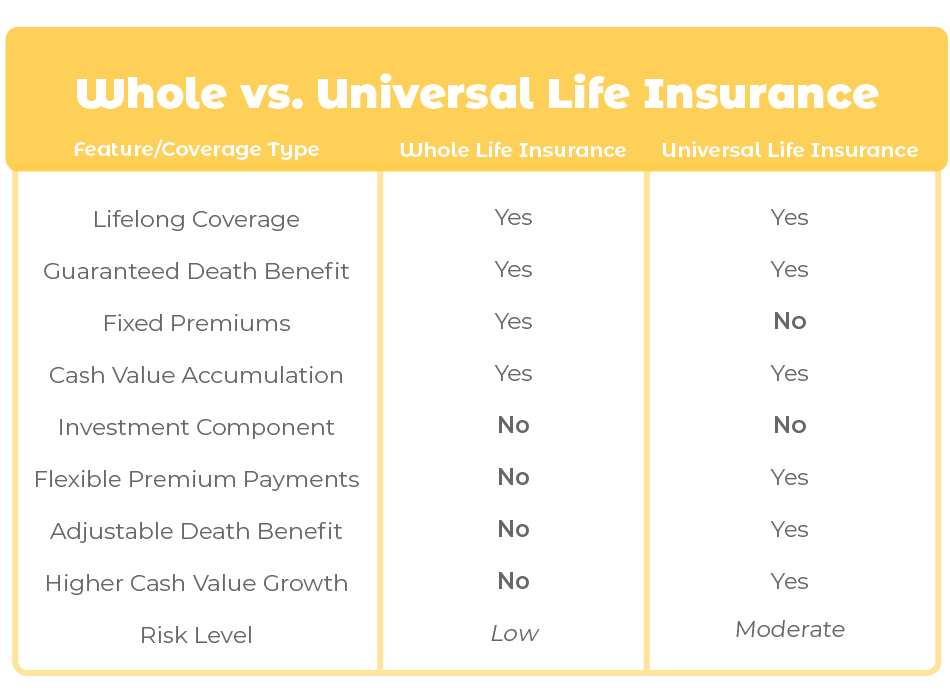

What makes universal life insurance flexible?

Universal life insurance allows you to adjust premium payments and death benefits over time. This flexibility makes it ideal for evolving financial goals or life changes.

Is variable universal life insurance a good choice?

Variable universal life insurance offers investment opportunities, allowing your cash value to grow based on market performance. However, it involves some risk, making it ideal for those comfortable with market fluctuations.

What is survivorship life insurance, and who needs it?

Survivorship life insurance covers two people and pays out after the second person passes away. It’s popular for estate planning, leaving an inheritance, or managing taxes.

How much life insurance coverage do I need?

Your coverage amount should account for:

- Your income replacement (e.g., 5–10 times your annual salary).

- Outstanding debts like mortgages or student loans.

- Future expenses such as education or healthcare for your dependents.

Use our free quote tool or call us for personalized advice.

How can I get a life insurance quote in Spokane, WA?

Getting started is simple!

- Call us at 509-928-7528.

- Or, fill out our online contact form.

We’ll customize a plan to meet your family’s needs and budget.