How to Navigate Wildfire Danger Without Homeowners Insurance

Wildfires can pose a significant threat to your home and safety, and navigating wildfire without home insurance can be especially challenging. While having homeowners insurance is ideal, there are still steps you can take to protect yourself, your family, and your property. Here’s a comprehensive guide to help you navigate wildfire danger without homeowners insurance.

1. Stay Informed

- Monitor Alerts: Sign up for local emergency alerts and keep track of wildfire updates through news sources and weather apps.

- Understand Risks: Learn about the wildfire risk in your area by checking with local fire departments or using online resources.

2. Create a Wildfire Action Plan

- Evacuation Routes: Identify multiple evacuation routes from your home and practice them with your family.

- Meeting Points: Establish safe meeting points in case you get separated.

- Communication Plan: Ensure all family members know how to contact each other and where to meet.

- Essentials: Pack water, non-perishable food, a first-aid kit, flashlight, batteries, and a multi-tool.

- Personal Items: Include medications, important documents, clothing, and hygiene items.

- Extras: Consider adding N95 masks, a battery-powered radio, and cash.

4. Create Defensible Space Around Your Home

- Clear Vegetation: Remove dead plants, leaves, and branches within 30 feet of your home.

- Trim Trees: Prune trees to keep branches at least 10 feet from other trees and structures.

- Fire-Resistant Landscaping: Use fire-resistant plants and materials around your property.

5. Harden Your Home

- Roof and Vents: Use fire-resistant roofing materials and cover vents with metal mesh to prevent embers from entering.

- Windows and Doors: Install dual-pane windows and ensure doors are fire-resistant and close properly.

- Decks and Porches: Clear flammable materials and use fire-resistant decking.

6. Create an Emergency Financial Plan

- Savings: Set aside emergency funds to cover potential evacuation costs and temporary living expenses.

- Credit: Maintain good credit and keep credit cards available for emergency use.

- Community Resources: Familiarize yourself with local resources and shelters that can provide assistance during a wildfire.

7. Document Your Belongings

- Home Inventory: Create a detailed inventory of your belongings, including photos and descriptions.

- Important Documents: Keep copies of important documents (e.g., IDs, deeds, medical records) in a safe place, preferably in a fireproof box.

8. Stay Ready to Evacuate

- Vehicles: Keep your car fueled and ready for evacuation.

- Go Bags: Keep emergency kits and important items packed and easily accessible.

- Pets: Prepare a plan and kit for your pets, including food, water, and carriers.

9. Know Your Community Resources

- Local Fire Departments: Know the locations and contact information of local fire departments.

- Community Groups: Join local community groups or social media pages focused on wildfire preparedness and response.

- Shelters and Aid Centers: Identify potential evacuation shelters and aid centers in your area.

10. Help Protect Your Finances

- DIY Repairs: Learn basic home repair skills to handle minor fire damage yourself.

- Seek Assistance: Look for grants, loans, or assistance programs from local government or non-profits for post-fire recovery.

- Barter and Trade: Consider bartering services with neighbors or local businesses for needed repairs or supplies.

Navigating wildfire danger without homeowners insurance requires careful planning and proactive measures. By staying informed, preparing your home, creating an emergency plan, and knowing your community resources, you can enhance your safety and minimize potential losses. Remember, the key is to be prepared and stay vigilant, ensuring you and your family can respond swiftly and effectively in the face of wildfire threats.

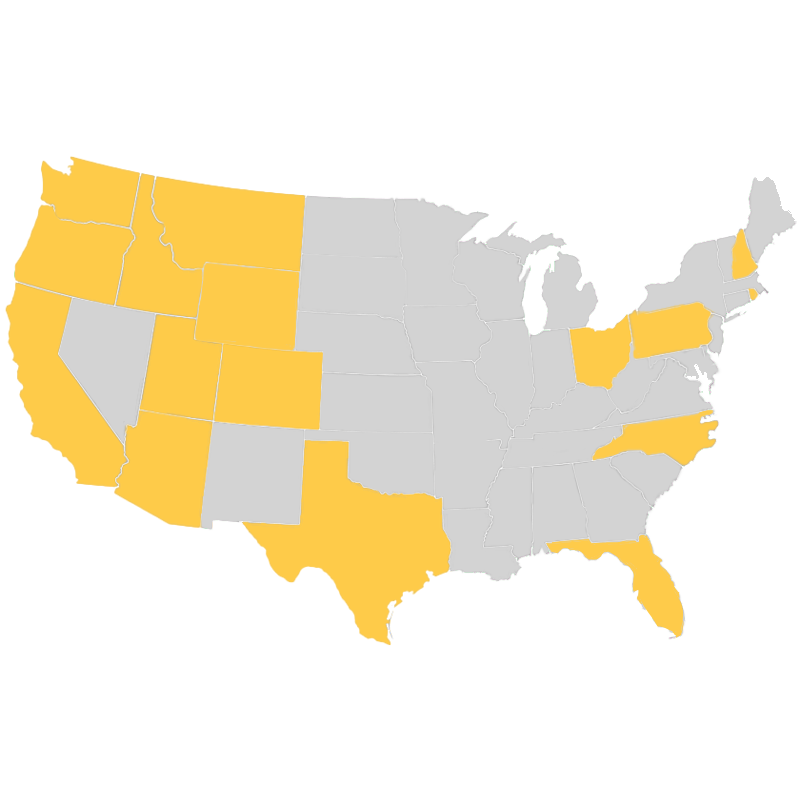

About Associated Agents Group

Securing homeowners insurance in wildfire-prone areas can seem difficult and unaffordable. Many homeowners are either restricted by insurance companies due to high-risk zones or believe they can’t afford coverage. As independent insurance agents, we have access to over 30 different insurance companies, allowing us to find the right policy for you. Whether you’ve recently been dropped by your insurer or think home insurance is too expensive, we consider your budget, needs and concerns to find your perfect match. Contact us for a free quote at 509-928-7528 or learn more about homeowners insurance today.