Insurance to protect against wildfire – Homeowners Insurance

By Madison Bortfeld

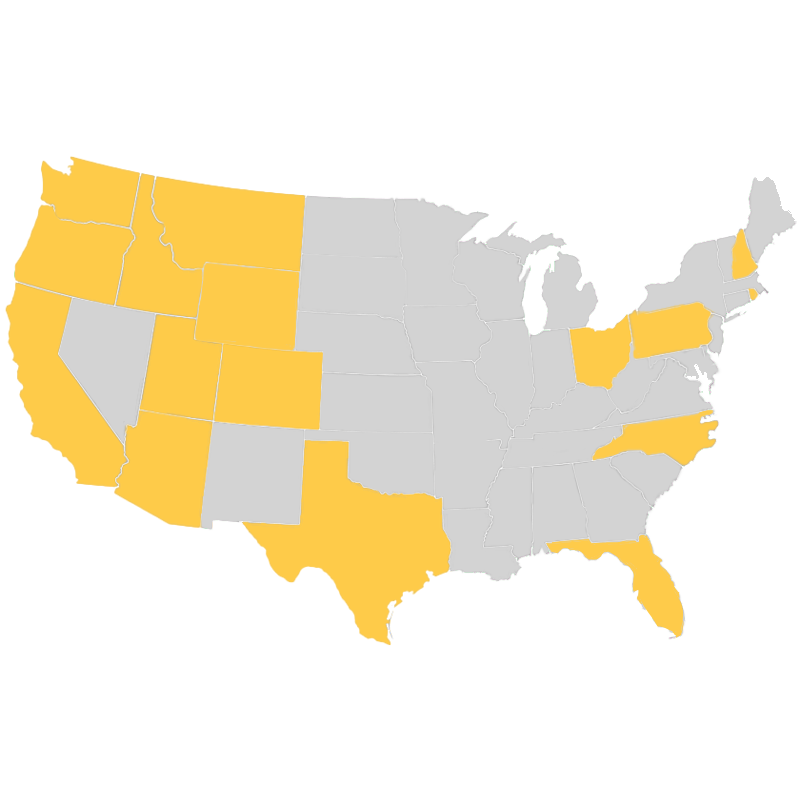

Every year, there are about 70,006 fires per year, with about 3.2 billion or higher in damage across the United States. But, having the right homeowners insurance to protect against wildfire can be a life changer. Wildfires destroy everything in their path and are often uncontrollable. Unless otherwise excluded, a typical homeowners insurance policy should cover damage to your dwelling, other structures and personal property. A renters insurance policy should cover damage to your personal property. The amount and type of insurance pay out is dependent on which provider you choose and your policy. Make sure to read the fine print, because some homeowners in regions with high risk from wildfires may not qualify for standard homeowners insurance.

Just recently, our community in Spokane County and Medical Lake experienced a wildfire that burned hundreds of structures, with lives lost. Now, the Gray fire is 58% contained, but the impact left many homeless, without resources & some even without loved ones. It has been tragic. Thanks to community resources, amazing volunteers, generous businesses & Red Cross, many have been able to make the best out of their circumstances. If that’s you, we’ve outlined some resources that may be able to help, here.

With Homeowners Insurance, you can have more peace of mind knowing your home structure will be covered in case of a fire or wildfire. Though it won’t be a piece of cake, you won’t have to start everything over completely from scratch. Especially if you choose your coverage wisely and get the best coverage possible. We can help you do just that. A typical homeowners insurance policy includes dwelling coverage. It protects the building and will cover the expenses to repair or rebuild if you have damage from certain events. Some of those unfortunate events include: Fire, Windstorms, Hail, Lightning, Theft & Vandalism. Your Homeowners Policy will typically include a percentage of your dwelling coverage to include personal property coverage. And you can increase or decrease the limit to fit your unique needs. If you’d like to purchase Homeowners Insurance, we’d love to help.

Your Partner in Coverage

We can guide you through the entire process, choosing your policy and adjusting it to fit your unique needs and budget. If the time ever comes when you need to file a claim, we’ll walk you through the process and be your advocate. We keep great relationships with our reps and with 20+ years of experience in the industry, know how to make sure you get the coverage you deserve when you need it most. Get in touch with a trusted agent today. Call us at 509-928-7528.

Get In Touch For A Complimentary Quote

Personalized to fit your unique insurance needs

By submitting your phone number, you are authorizing us (opting in) to send you text messages and notifications. Message/data rates apply. Reply STOP to unsubscribe.

Article Resources

https://www.bankrate.com/insurance/homeowners-insurance/wildfire-statistics/

https://inciweb.nwcg.gov/incident-information/wanes-gray-fire