Navigating the Hard Insurance Market | 2024

In the ever-changing landscape of insurance, staying afloat amidst market shifts and rising insurance premiums can feel like navigating stormy seas. As we weather the challenges of the 2024 Hard Insurance Market, it becomes increasingly crucial to have a reliable ally in your corner. This is where independent insurance agents step in, offering stability and support amidst the turbulence. Here’s why partnering with an independent insurance agent can help you not only stay afloat but thrive during these challenging times.

1. Access to Multiple Carriers Under One Roof: Independent agents have the authority to shop around among various insurance carriers, all while managing your policies under a single roof. This means you don’t have to hop from one provider to another in search of the best rates or coverage options. Instead, you can rely on your independent agent to do the legwork for you, finding the optimal solutions tailored to fit your specific needs.

2. Thorough and Unbiased Review: In the midst of market fluctuations and rising insurance premiums, your insurance needs may evolve. Independent agents provide a comprehensive and unbiased review of your insurance portfolio, identifying areas where adjustments can be made to better suit your evolving requirements. Whether it’s updating coverage limits, exploring new policy options, or consolidating policies for efficiency, your independent agent is there to ensure you’re adequately protected without paying for unnecessary coverage.

3. Personalized Service, No Automated Hassles: Imagine calling your insurance provider and being greeted by a friendly voice instead of navigating through endless automated menus. With independent agents, this is not a mere fantasy but a reality. When you reach out for assistance, you’ll speak directly with knowledgeable staff members who are ready to address your concerns and provide personalized guidance. Moreover, unlike larger corporate entities, independent agents prioritize building lasting relationships with their clients, offering the option for in-person meetings to discuss your insurance needs face-to-face.

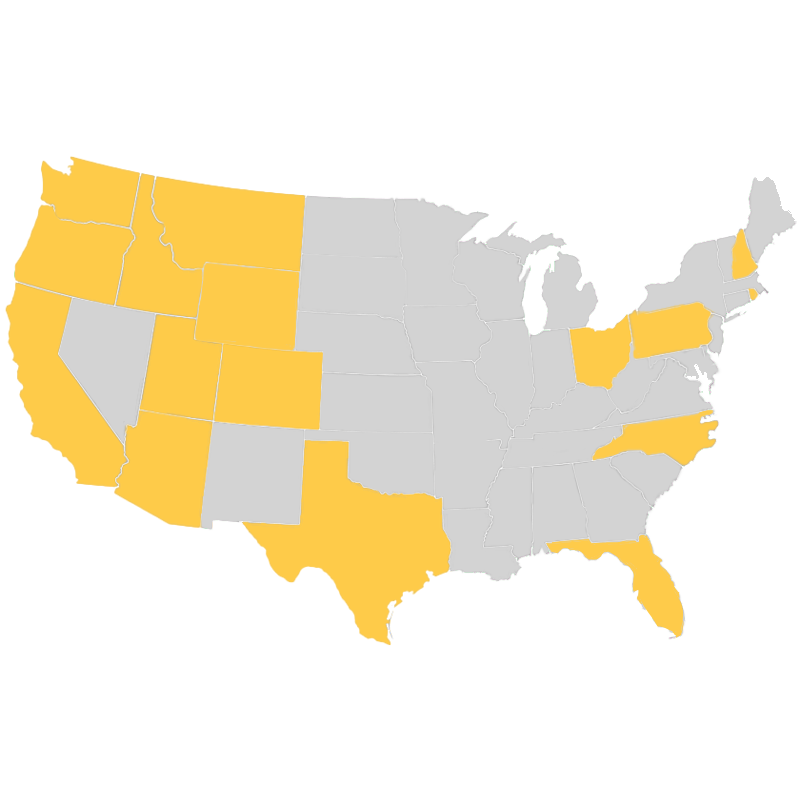

At Associated Agents Group, we understand the challenges posed by rising insurance premiums during the 2024 Hard Insurance Market, and we’re here to help you navigate through them with confidence. Our team is committed to providing the best possible service and serving as your advocate when you need it most. Whether you’re a current client with us or exploring insurance options for the first time, we’re here to guide you every step of the way.

Contact Us: Ready to experience the benefits of working with an independent insurance agent? Give us a call at 509.928.7528 to learn more about how we can tailor insurance solutions to meet your unique needs. Don’t let the turbulence of the 2024 Hard Insurance Market leave you adrift – partner with AAGI and sail ahead with confidence.